Exploring Culture and Transformation Opportunities

On 2 July, Michael Ruckman, the founder of consulting firm Senteo Inc., former Chief Transformation Officer of Alfa-Bank and Business Transformation expert, delivered a workshop in Bishkek organized by Bai Tushum Bank.

During the workshop, Michael shared with the audience some secrets of corporate culture and the right approach to long-term relationships with customers and, more importantly, explained when the best time is for transformation of a business to avoid failure and improve financial performance in times of crisis.

For our readers, Akchabar publishes Michael’s answers to the most interesting and relevant questions about business.

Your training is about transformation. What businesses need it? How could we understand whether we are ready for transformation?

Any business goes through development cycles, and most of them are linked to customer needs, preferences, and behavior. If a business is hoping to find a new offering, first of all, it needs to understand what will ensure the highest value to the customer and what is consistent with their personal qualities and desires. I call it the “Customer Rule,” and it is quite simple, really – customer needs, preferences, and behavior will determine the success and longevity of almost any offering.

Development cycles have four generally accepted phases:

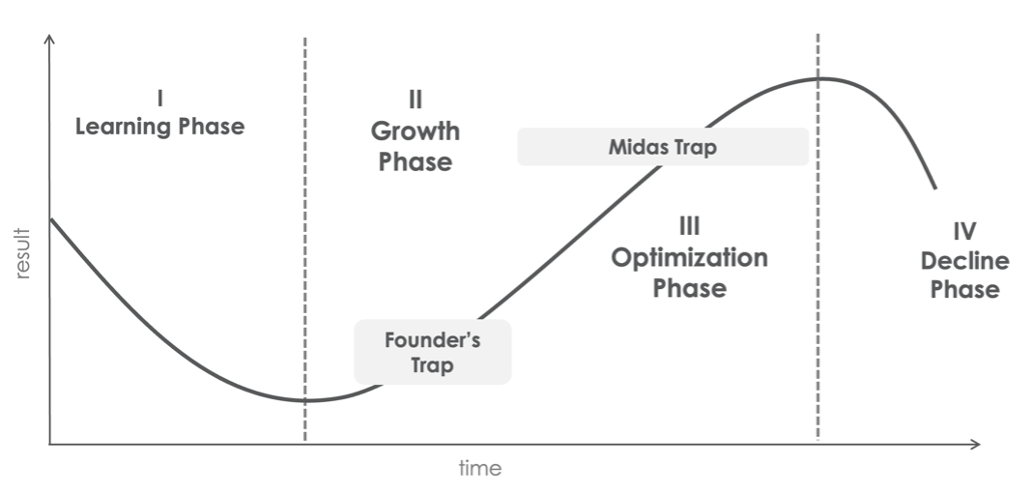

Based on this rule, a business cycle looks like this:

- Phase 1 – Companies seeking a new value proposition will work find the model that matches customer needs, preferences, and behavior as that is the formula that will attract the most customers to this new offering. This is commonly referred to as the learning phase.

- Phase 2 – Usually referred to as the growth phase, this phase will see significant response from customers (rapid growth of the customer base) and sometimes frantic efforts to keep up with demand if the offering is very popular.

- Phase 3 – The optimisation phase. This phase of the development cycle will start with optimizing business processes and operating models to keep up with the demand from customers, but it continues with trying to maintain the financial performance of the new offering even though some things seem to be slowing down. In most cases, there may be some evident changes in demand based on evolving needs, preferences, and behavior of customers, but business often do not want to acknowledge these changes, so they work to maintain the status quo through optimization rather than jumping to the next development cycle.

- Phase 4 – If busineses fail to recognize the slowing demand, they may enter this phase of general decline as their offering has likely become stale in the eyes of the consumer. In theory, businesses should be exploring new opportunities at the end of the growth phase or beginning of the optimization phase, but for some reason, people often fail to recognize this shift in customer needs, preferences, and behavior, and it often leads to the complete demise of businesses.

Unfortunately, businesses often wait too long, and once they have entered the decline phase they often need immediate and intense actions to stop the business from declining to potentially significant losses. That means urgently identifying the next new offering that will meet current customer needs, preferences, and behavior and quickly implementing the changes required to launch this new offering. This type of transformation has many drawbacks and risks largely in two categories: 1) there is very little time to test the new offering, which can lead to mistakes or flawed assumptions related to customer needs, preferences, and behavior; and 2) leaders often must force the change in an accelerated format, which can cause resistance and sometimes even sabotage in the implementation of the new offering.

Is transformation a similar process for all companies or does it involve adaptations for each individual company? What might that depend on: the scope of change, market conditions, availability of resources?

Approaches would vary from company to company, as there is no one-size-fits-all formula. The availability of resources and type / scope of change surely have an influence, and the market environment definitely affects the speed of development cycles. However, you should keep in mind that every company has its own personality, its DNA, and therefore, each transformation program will be different. The transformer supporting this process has to find the formula which would work specifically for this very company. As I’ve mentioned, if the business is mature, mindful, and is able to recognize the need for change, it is possible to manage the evolution of the business model – identify, detail, develop, and launch the right new offering – and avoid the period of decline.

More difficult: we often find companies with various business units that may be at different stages of their development cycles. For instance, if one business unit is in the growth phase, while the other is in and optimization or decline phase, it is often difficult to merge the change efforts into one cycle of evolution. This is much more challenging.

In summary, I could say that each business is going to be quite unique in its development.

Today you’ve talked about corporate culture. In your opinion, is there a developed corporate culture in Kyrgyzstan? How could you assess it?

It’s a good question. Although I don’t have enough information about development of corporate culture in Kyrgyzstan, I could note that every company has its own corporate culture. Therefore, it is difficult to find a market standard.

From this perspective, when we start any transformation project, we have a detailed approach assess the organizational readiness for change within an individual company. If the organization is more flexible – open to new concepts, changes and new opportunities – this makes the transformation (or evolution) much easier. Those organizations which are more rigid – less open to new ideas, believe they know everything and think that the old approach would always work better – usually end up with a forced transformation to salvage what’s left after significant decline.

For the business considering customer-centric or relationship-centric business models, there is a whole series of various cases showing that these models generate more income and have a more stable customer base. There are a lot of reasons why businesses want to move to this model, but it is an individual strategic decision for each company.

These definitions of corporate culture and readiness for change will allow us to define the parameters of any change program to take into account the specifics of each individual organization, and that is merely the first step in designing a successful change program.

What do you think about the success of the customer-centric business models? What are the fundamental differences between relationship-centric, customer-centric and product-centric businesses?

Here, I would say that not all businesses need to be customer-centric or relationship-centric. There are some very successful product-centric businesses in the world, and for many of them there is no current need to change their business models. Typically, the motivation to consider customer-centric or relationship-centric business models comes from a market saturation of competitors with similar offerings, which leads to less differentiation between competitors and more price sensitivity from customers who have multiple choices of very similar offerings. In these cases, businesses must consider one of two directions: 1) become a low or lower-cost provider by optimizing all organizational costs to maintain margins with a lower, more competitive price, or 2) consider ways to improve the value provided to customers, the quality of customer contacts, and the quality of customer relationships. This second direction would stimulate the consideration of customer-centric or relationship-centric approaches in general.

What is your key recommendation for businesses in Kyrgyzstan to be more successful?

I would recommend reviewing in more detail the Customer Rule that I mentioned at the very beginning of this interview and use it as your guide in business development. Being in tune with customer needs, preferences, and behavior will always be good for business. I also think businesses should find partners who have experience and a track record in supporting such transformations. Together with a strong partner network, businesses can avoid many mistakes and accelerate the transformation / evolution process, thus achieving the change and generating stable results much quicker.

Everyone will find their path to the business transformation / evolution. It is simply a matter of choosing the approach and sticking to it. When in doubt, it helps to find partners who have been through this process many times before.

Why did you accept the invitation from Bai Tushum bank to deliver such a workshop in Bishkek?

It was an easy decision for me. First of all, as a person living in Eastern Europe for the past 22 years, I have always been interested in Central Asia, but didn’t have the chance to research and visit the Kyrgyzstan market. So this opportunity to travel to Bishkek, experience the local culture, and meet new people seemed like a great idea.

Secondly, in Tashkent I met the Chairman of the Bank Maksatbek Ishenbaev. We’ve had a very good discussion, and I learned of his desire to create a more flexible and more adaptive organizational model. That is a very exciting and challenging objective and the opportunity to share some knowledge and add value for the team of Bai Tushum Bank seemed also a very worthy reason for the trip and the workshop.

And thirdly, it was an easy decision because I love new opportunities. I am a career transformer. For 26 years I’ve worked on transformation of business models, organizational models, and corporate culture. To help Bai Tushum Bank to be one of the first in the market with a new, adaptive and customer-centric business model would be a very exciting project.

All these things were and are very good reasons to explore the opportunity further.

Sales training for front line along with basic development and coaching principles for line management.

Understanding how leaders must evolve with relation to the evolution of business models, new management models, and the significant changes to the workforce with Digital Natives now making up more than 50% of the workforce globally.

Understand the theory and mechanics of developing and managing a customer-centric and experience-driven corporate culture that is consistent and stable and includes elements of Employee Experience (EX) and Employee Relationship Management (ERM).

Understanding the evolution of leadership styles, management models, organizational structures, performance measurement and guiding change in the evolution of business models from product-centric to customer-centric and even relationship-centric.

Understand how to manage both internal and external digital transformation while considering the landscape for digital business models and the effect on traditional business models. Understanding organizational readiness for transformation and the role of corporate culture in managing transformations.

The changes in consumer behavior, employee behavior, and the evolution of business models in the digital age cause significant difficulties and imperatives for leaders who must develop new skills and evolve their leadership styles to be effective in this fast changing, challenging, and competitive environment.

Understanding how leaders must evolve with relation to the evolution of business models, new management models, and the significant changes to the workforce with Digital Natives now making up more than 50% of the workforce globally.

Understand how to manage both internal and external digital transformation while considering the landscape for digital business models and the effect on traditional business models. Understanding organizational readiness for transformation and the role of corporate culture in managing transformations.

The changes in consumer behavior, employee behavior, and the evolution of business models in the digital age cause significant difficulties and imperatives for leaders who must develop new skills and evolve their leadership styles to be effective in this fast changing, challenging, and competitive environment.

Understanding how to design & manage change/transformation programs in organizations of different sizes. This course will help any size team or organization to better deal with change & transformation on any scale.

Copy Link

Copy Link

E-mail

E-mail

LinkedIn

LinkedIn

Facebook

Facebook

Telegram

Telegram

WhatsApp

WhatsApp

Go Back

Go Back

Leave a Reply

You must be logged in to post a comment.